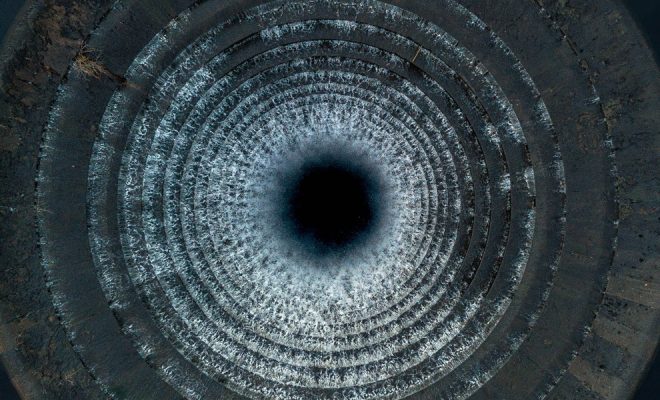

Climate change suggests an increase in droughts on the west coast of the United States, which will make the physical and financial value of water skyrocket. © bluesbby.

On December 7th, water was listed on the Wall Street futures exchange. The Nasdaq Veles California Water Index (NQH20), the water price index that was created a few years ago in California, was the first to actually trade it. The news has generated international debate, especially in industrialized countries that suffer hydric stress and where controversy and political fluctuations between the public and private management of water are common. Concern has also arisen among those who work for the universal attainment of SDG 6, the sustainable development goal whose attainment must guarantee the universal access to water, an internationally recognized and vital human right for the planet.

Futures markets, a very ancient practice

What does the listing of water on the stock exchange imply? First of all, certain issues need to be clarified. The first thing is to understand the meaning of a futures market. This type of market consists of contracts for the purchase or sale of certain commodities at a certain date in the future, with the buying and selling parties agreeing, at the time of the contract, on the price, quantity and maturity.

In fact, futures contracts have been used since the classical Greek period, being mainly applied to basic needs products, such as grains or oil, although their use has extended over time to products like gold, cotton or oil. These transactions originated with the purpose of controlling the risks due to possible fluctuations in the availability and prices of commodities.

However, in the case of water it is important to point out that it is not a matter of buying and selling water directly, as if it were wheat, soy, oil or gold, but rather the rights to have access to it, and this implies a difference to the futures markets in which these commodities are indeed exchanged.

In Australia, Chile, Spain, South Africa, Iran, India and vast areas of the USA, public administrations grant water use rights through concessions. © Justyna Lewko.

In fact, these transactions are common in many countries with a developed irrigation agriculture and a high urban demand that are subject to water stress, such as Australia, Chile, Spain, South Africa, Iran, India and vast areas of the USA. In these cases, public administrations grant water use rights through concessions and the administrations themselves guarantee and ensure the correct management and sale so that the human right to water is respected.

The initial public offering, a milestone event

But while it is not new to trade or sign contracts for the purchase and sale of water use rights, the launch of this price index on the Wall Street stock exchange is a historic first. From a merely financial point of view, in a free-market economy like the U.S. one, this is the logical evolution of an essential commodity that is becoming scarce.

That is the case of California, where the availability of water and its price experience endemic fluctuations mainly depending on climate, pollution or the increase in demand. It needs to be said that the price per cubic meter of water in California doubled in 2019, while the demand continues to increase due to the population growth and the government has not been able to control the pollution of rivers and aquifers. On the other hand, climate change, which is already deteriorating the west coast of the United States, will likely increase droughts, making the physical and financial value of water skyrocket.

Therefore, the NQH20 index is a way of measuring the forward price of the contracts for access to water in California. With it, licenses, permits or water rights are put up for sale to the highest bidder.

The threat of financial speculation

The value of water cannot be only financial: value of water is based on other essential assets such as the preservation of the environmental natural capital and the attainment of nearly all SDGs. © UN Photo/Albert González Farran.

The economists who are free-market advocates claim that, due to the creation of economic incentives, the stock market price of water rights will improve their management and the efficiency of its use, so far very deficient in many basins suffering water stress. Incentives will be generated from the sale of surpluses on the stock exchange which, in their opinion, will provide liquidity to finance investments that improve water conservation, thus ensuring water security in a risky future.

Those against the initial public offering claim that the fact that the international price of water fluctuates according to supply and demand is a deformation of its real value. The introduction into the market of other actors merely interested in the economic benefits provides a fertile ground for financial speculation, and it is clear that the deregulated exploitation of water resources thus projects a business that will become increasingly attractive to investment funds.

For more than 800 million people that lack sufficient access to drinking water, its value is synonymous with health, education, gender equality and development possibilities. © Hamish John Appleby for IWMI.

Speculation with water could have dire consequences on the social gap between rich and poor countries, on political stability and the environmental future of the planet. It could also make us forget that the value of water is based on other essential assets such as the preservation of the environmental natural capital and the attainment of nearly all SDGs. For more than 800 million people that lack sufficient access to drinking water, its value is synonymous with health, education, gender equality and development possibilities; it means not having to migrate to escape poverty and be able to feed their families; it means dignity and justice. These are no financial values, but they are much more necessary for the achievement of a sustainable and ethical planet.

The value of water is food security. ©Philip Junior-unsplash.