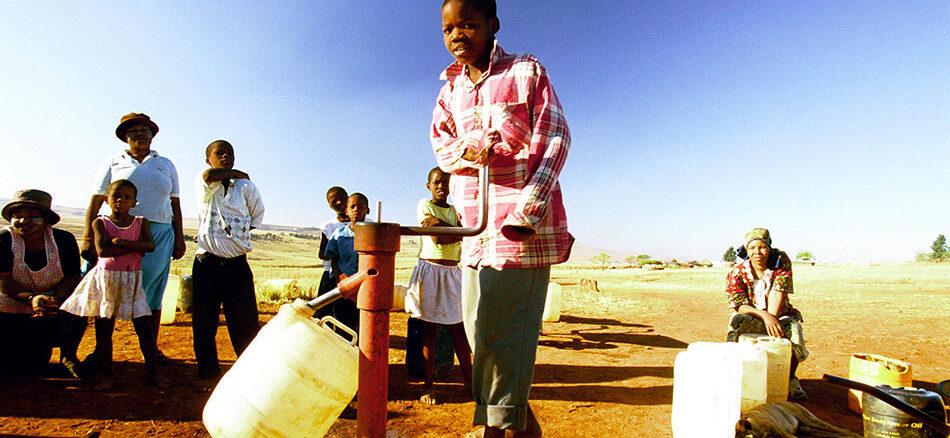

Funds are essential for addressing water challenges. According to the JMP, in 2022, 296 million individuals still lacked access to safe water, while 115 million depended directly on surface water sources like rivers and irrigation channels. Progress is being made, albeit gradually; the UN anticipates that SDG 6 will not be met by 2030. Nevertheless, concerted short-term efforts can uplift millions from water poverty. Crucially, investing in infrastructure is paramount.

Accelerating investment in water infrastructure is urgent. © Kelly

Calculations Have Been Made; the Investments Remain to be Done

Slightly over a year ago, the United Nations Water Conference echoed the World Bank’s call for USD 300 billion to ensure global water security and sanitation. According to the financial institution, this investment would yield one trillion in benefits for humanity, meaning a tenfold return for every three USD invested.

However, this impressive figure hasn’t spurred investment. At COP 28, challenges arose in defining and implementing the Loss and Damage Fund, which is crucial for financing climate change adaptation in the most vulnerable nations. Geopolitical instability stemming from the war in Ukraine, numerous conflicts in Africa, and recent tensions in the Middle East due to the Gaza war have heightened investor risk.

Investment in targeted water access and watershed management initiatives faces similar obstacles, highlighting the pressing need for action. Insurer’s reports unequivocally identify water-related risks as the primary global threats over the coming decade. Droughts, natural disasters, extreme weather events, heat waves, and biodiversity loss stem from water cycle disruption and inadequate water resource management. Urgency is paramount, especially with the accelerating pace of global warming.

Investing in water in developing nations yields tangible benefits. © Trevor Samson / World Bank

A Pragmatic Call

Recently, the World Bank projected that USD 6.7 billion will be necessary for water access infrastructure by 2030, with an expected increase to USD 22.6 billion by 2050.

To render investments viable and incentivize funding, the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA), and the World Bank’s 2030 Water Resources Group have taken a pragmatic approach by establishing the Strategic Framework for Scaling Up Finance for Water.

This initiative focuses on four pivotal areas to stimulate financing and innovation in developing nations: creating investment-friendly environments, leveraging private sector expertise, diversifying financing solutions, and enhancing public understanding of climate-related outcomes. It represents a significant stride forward in addressing the financing challenge, laying the groundwork for enhanced public-private collaboration, and actively inviting company engagement.

Helping The Most Disadvantaged is Beneficial for Everyone

Water demand is projected to surpass supply by 40% by the decade’s end. Investing in infrastructure is pivotal to bridging this gap and facilitating adaptation to the consequences of global warming, particularly for nations least responsible for its onset.

This endeavor yields global benefits. Developing solutions in less advanced regions fosters equity and enables companies to innovate and enhance their expertise in infrastructure and cutting-edge technologies. Tangible progress can be observed in the advancement of rainwater harvesting systems, low-cost desalination technologies, efficient irrigation methods, and more, which can be scaled up based on experiences in underserved areas.

The benefits extend beyond financial gains. Investment in water supply infrastructure generates revenue from service provision and promotes water resource conservation, ecosystem restoration, pollution prevention, and biodiversity preservation — termed “positive externalities” by economists. These externalities hold significant economic and social value, especially within the broader context of climate change.

The social benefits of these externalities are profound. The enhancement of health and quality of life through access to safe drinking water and basic sanitation is undeniable. This outcome is consistently observed across all our projects: over three and a half million beneficiaries have experienced improved health and living standards, and women have gained security and empowerment within their communities, leading to greater cohesion. Consequently, children are not forced to interrupt their education, paving the way for a brighter future. This aspect is crucial in mitigating migratory crises and laying the foundation for resilience in climate-related challenges. Ultimately, the youth hold the key to humanity’s salvation.

The enhancement of health and quality of life through access to safe drinking water and basic sanitation is undeniable. © World Vision

Creating the Right Context

Achieving such substantial investment levels requires fostering the right environment and exploring new avenues. Governments play a crucial role in establishing conducive conditions and implementing reforms to facilitate increased flows of public and private financing into the water sector. Simultaneously, international financial institutions and multilateral development banks must offer national-level support for solutions that enable private capital, blended finance, and credit enhancement to mitigate public sector risk.

Both the public and private sectors have traditionally underestimated the value of water. In many countries, the price of water fails to reflect its true economic worth or cover the costs of water service provision. The contentious debate surrounding water’s public versus private nature has impeded private sector investment. While water is a fundamental human right, ensuring this right for all requires a robust infrastructure. Addressing a challenge of this magnitude demands an unprecedented response. The public sector cannot solely achieve progress toward SDG 6 targets; close collaboration with companies is imperative. They need to understand the comprehensive impact and returns on their investments from a broad economic standpoint.